Poland’s energy transition is progressing, and 2023 was a year of real records. Although coal remains the main source of electricity production, its share in the mix fell to an all-time low of 60.5 percent, down 10 p.p. from a year earlier. Production from renewable energy sources (RES) reached 27 percent for the first time. At the same time, energy production from natural gas increased, by more than 40 percent. This is a result of falling fuel prices and the flexibility of gas generation. Wholesale energy prices in Poland compared to other EU countries remain very high, and the economy’s dependence on imported fossil fuels is growing rapidly. In the latest, seventh edition of the Energy Transition in Poland report, Forum Energii presents the state of transition play and a broader look at the overall process.

The pressure for changes in the energy sector—on which the development of Polish GDP will depend—is growing. In recent years, most of the changes have been on the generation side, as the role of coal declines, renewables are stepping in, although the development of the latter is not through a conscious state plan towards investments in RES, but rather the result of the market and the lifting of blockages. However, the Polish electric power industry is still the most emission-intensive in the entire EU, and the country is the third most emission-intensive in the world. This significant level of emissions translates into high energy prices, and in industry, into a decrease in competitiveness due to the high carbon footprint of goods produced in Poland. If nothing changes, the Polish economy will be exposed to a decline in investment in the coming years.

However, while progressive—though still insufficient—changes are beginning to be seen in the electricity sector, they are almost absent in other sectors, such as heating and industry. That’s why it’s becoming so important to look at energy use across the entire economy: comprehensively, and not just by individual sectors.

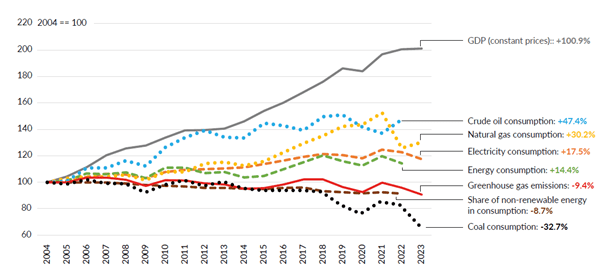

During the 20 years of membership in the EU, the consumption of energy and fuels, especially transportation fuels, in Poland has been steadily increasing.

“Year after year, changes in the power sector are accelerating, but they are the result of megatrends and the market, more than a conscious state plan. Good coordination is needed so that changes in generation are followed by changes on the grid and market organization side, including improved flexibility. Someone needs to look at energy holistically—you can’t just focus on the mining sector or energy prices. Decision-makers are missing the fact that the energy industry is for the people, and this complicated puzzle needs to be set up to communicate in a fair and transparent way the real costs, but also the challenges of emissions reduction and energy security in a very volatile and unstable world,” said Joanna Pandera, PhD, president of Forum Energii.

Capacity factors and system security

The lack of a coherent plan for the transition is resulting in increasing risks to balancing the system and maintaining its security. The unavailability of conventional units is increasing year after year. The level of capacity reserves remains low (last year it was as low as 1.4 GW, which is not improved relative to 2022), the share of available capacity is falling, and the flexibility of sources is not increasing, so the security of the national power system is not improving.

“The low flexibility of Poland’s electricity system is becoming increasingly troublesome. The generation infrastructure is outdated. Along with the necessary development of RES, the inability to quickly adjust conventional controllable sources to the needs of the system is becoming a problem. Inflexible coal units are unable to operate at sufficiently low minimums at a sunny noon and then increase their output quickly enough in the evening. Added to this is the almost total lack of energy storage. This combination forces the TSO to limit the operation of renewables, despite the fact that they produce almost free energy at that time. In 2023 alone, 74 GWh of electricity was lost in this way, but the scale of the problem is growing rapidly. From January to mid-May this year, the curtailment affected more than 400 GWh of energy. That’s as much as nearly half a million households consumed in that period,” said Marcin Dusiło, senior analyst at Forum Energii and the author of the report.

Dependence on fuel imports continues to grow

An important change that has taken place in the last two years is the acceleration of the process of diversifying the directions from which Poland imports energy resources. In 2023, gas and coal imports from Russia were completely replaced by purchases from other countries, and the volume of oil imports was small. Currently, Poland maintains a clear dependence on Russia only in the area of LPG imports.

However, replacing supplies from Russia does not mean that Poland imports less and that it costs us less. On the contrary, dependence on imported raw materials is steadily increasing, already 43 percent of the energy consumed in the country is based on imported fuels. What’s more, due to market conditions, the bill for buying raw materials abroad is steadily rising. Last year alone, Poland spent PLN 138 billion (i.e., slightly less than on defense). Over the past decade, taking inflation into account, the cost of fuel imports has already exceeded PLN 1.2 trillion.

Energy driver needed right away

The energy transition in Poland has no helmsman. There is no single centre to manage the process, so the changes taking place are chaotic. Poland has never offered a comprehensive vision for the decarbonisation of the economy or a plan to reduce dependence on energy resources imported from abroad. Right now, with the Ministry of Climate and Environment developing a new National Energy and Climate Plan, it is the best time to set a clear direction for the transition. This is essential to prepare society and companies for the coming changes, important for targeting investments, mobilising business, lowering energy costs and planning spending accordingly.

“The Polish discussion around the transition focuses on the topic of closure and the end of coal-fired power plants, which is generating resistance. We don’t talk enough about new low-carbon technologies, including those that will provide dispatchable capacity. We face the spectre of an investment gap, yet a secure and sustainable supply of electricity is a prerequisite for the electrification of the entire economy. It becomes a huge challenge to mobilise investment, both in power companies and by private investors, including households,” said Joanna Pandera.